Why Churn prediction

Customer churn is one evil that all organizations dread. A well-informed customer base with multiple product and service options are not easy to retain. A robust and sustainable strategy for customer retention is very crucial. Retain, engage and increase the customer lifetime value can be achieved through Predictive Analytics.

Traditional churn analysis techniques were very heavily dependant on customer lifetime value calculations that relied on fixed metrics like average monthly transactions, monthly retention rate, average gross margins and so on and tend to show the reasons customers choose to terminate a relationship, but rarely in time for the company to act and prevent the customer from leaving.

With predictive analytics, you can get the information in time to adapt your communication, customer service and offers to meet your customers’ needs, thereby minimizing the risk that they will terminate their relationship with you.

One of the most popular Big data use case in business so far is Churn prediction. It exploits patterns found in historical data to help organizations grab opportunities and identify risks. Churn prediction consists of detecting customers who are likely to cancel a subscription to a service. Predictive analytics helps to lower the customer churn by cost-effective retention efforts specifically targeted towards identified users. Sophisticated handling of Churn is the sign of a mature organization. The cost of acquiring a new customer is way higher than retaining an old one. Hence, putting in efforts to retain customers is a smart move.

Churn prediction through predictive analytics in subscription-based business

Companies in nearly every industry have to address churn. It has the power to plateau the growth of any businesses even if that business is gaining customers quickly. The most successful companies address it by building predictive models that accurately predict churn; then they take action by building targeted marketing campaigns around preventing it or by making product changes that combat churn.

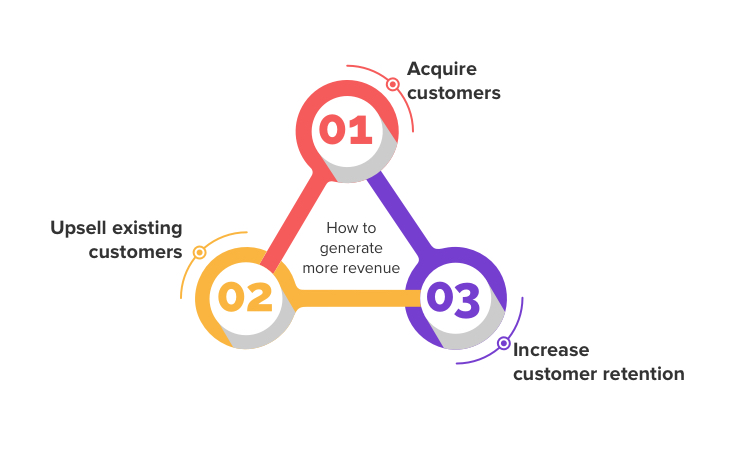

More revenue can be generated by following the following three simple strategies.

All the efforts have an associated cost. Ultimately the interest of the organization lies on the return on investment which is the ratio between the extra revenue and their costs.

The cost of attracting a new customer can be five times as high as the cost of retaining an existing customer. When you lose a customer, it is important to understand what type of customers choose to leave and why in order to minimize the risk of it happening again. A churn analysis can give you the answers to these questions. It provides a clearer overview of the risk among your existing customers and what types of customers you should prioritize in future prospecting.

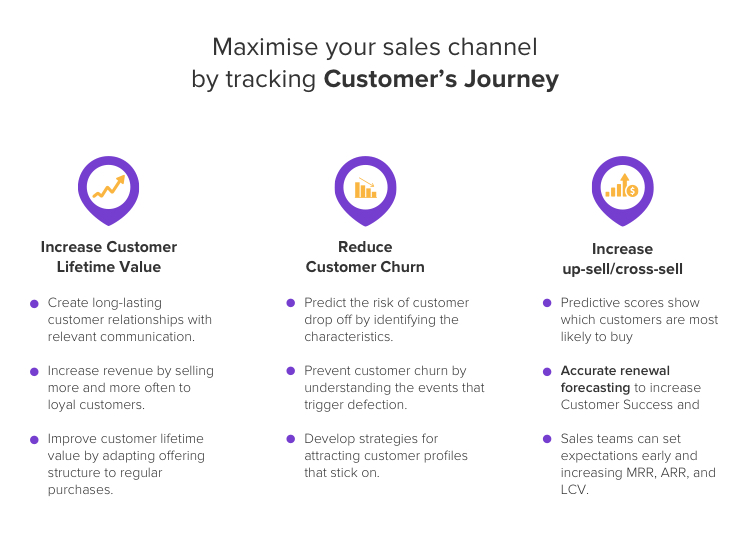

By working strategically with insights on which customers are likely to defect and which are most profitable over time, you can adapt your communication and offer to establish a long-term relationship with the customer profiles who have the highest customer lifetime value (CLV).

Maximise your sales channel by tracking Customer’s Journey.

Predictive Analytics fuels the Saas customer model at Tookan

Predictive analytics is a no-brainer for SaaS businesses who want to amplify the success they’re already having. From identifying prospects onwards throughout the customer lifecycle, predictive empowers you to add more value by delivering a personalized experience that better meets customer needs.

Kato used newer and accurate approach to customer churn prediction for Tookan: at the core of Kato’s ability to accurately predict which customers will churn is a unique method of calculating customer lifetime value (LTV) for each and every customer. The LTV forecasting technology built is based on advanced academic research and was further developed using predictive performance of Pareto/NBD and BG/NBD models from the customer base analysis literature — in terms of repeat purchase levels and active status — using Tookan transaction data. Kato also modified the BG/ NBD model to incorporate zero repeat purchasers.

This method though is not traditionally used in subscription-based models. The appropriate fit was worked out. It was battle-tested and proven as an accurate and effective approach in a wide range of industries including subscription models and customer scenarios.

‘Pattern Recognition’ approach is also another feature that helps to study anomalies in user behavior. Patterns can be predicted real time and alerts can be sent to check on behavior.

‘Variable Impact’ approach was used to identify the factors responsible for churn. Actionable were defined to control it at the source thereby reducing the chances of customer churn

As a result, Tookan reduced churn by 20%

Kato helped Tookan visualize their data in the form of extensive reports and analytics that has helped Tookan’s team multifold. It also helps to drill down data charts, graphs, reports and dashboards and discover hidden opportunities in the business data. It keeps a tab at a glance at whether or not the business is growing? what are our top accounts and what the MRR growth rate is- actionable insights? all at a glance.

Kato’s business intelligence software provides flexible connectivity to multiple data sources and seamless integration with third-party tools. Hence, promoting seamless collaboration and sharing. Kato simplifies every step of the business analytics process from data preparation, analytics dashboard to predictive insights.

Kato is the preferred software solution in helping small business succeed in the rapidly evolving data-driven business ecosystem. By an effective combination of diversity of mindsets and technologies, Kato’s purpose is to enable all kinds of enterprises to imagine and deliver the data innovations.

Subscribe to stay ahead with the latest updates and entrepreneurial insights!

Subscribe to our newsletter

Get access to the latest industry & product insights.