One topic that has been a constant source of discussion in grocery retail is Quick commerce and its unit economics.

With many prominent players operating in quick commerce looking to shut down or even turn towards mergers and acquisitions to stay afloat, one question arose. Is quick commerce dead?

While we have given our thoughts on this question in the past, we’re now looking towards understanding the unit economics of Quick commerce vs a brick & mortar grocery store.

When talking about entering into the grocery retail business, there are some factors that must be understood. One must understand the suitability and profitability behind both business models in order to arrive at a decision.

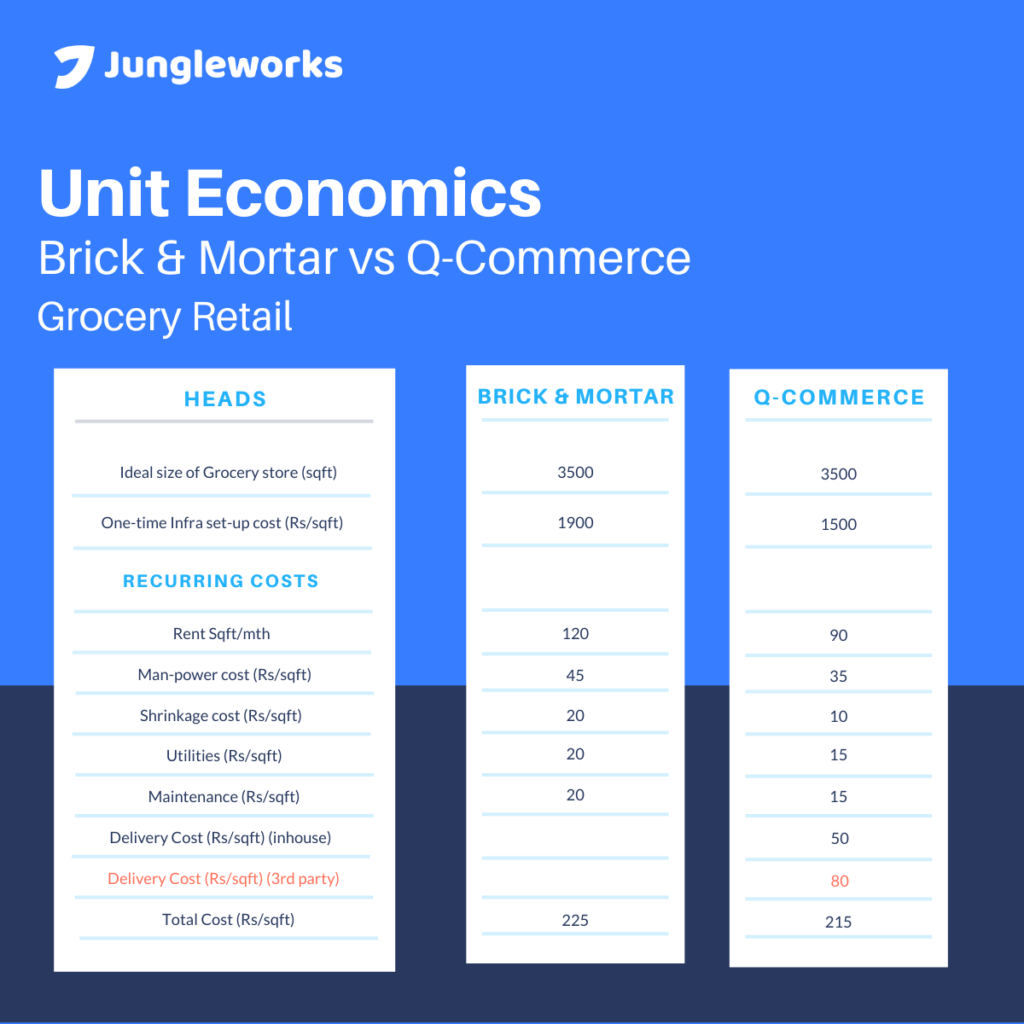

Brick & mortar vs quick commerce: unit economics for grocery retail.

For the purpose of this calculation, we have taken an assumption of expenses that are common to both business models. There are some subjective factors that we will discuss in detail ahead.

The expenses common to Brick & Mortar and Quick commerce

There are a bunch of expenses listed above. We’ll be discussing a bit about them and their impact on each business model.

For the purpose of understanding unit economics, a common store size in both cases at 3500 square feet.

1. One time infrastructure setup

While the other costs mentioned above are recurring in nature. Infrastructure setup cost is a one-time expense that includes all the basic necessities to set up a shop. For a brick & mortar grocery store, a lot of money is expended in creating an appealing ambiance. This will include furniture and fittings like large shelves, racks, open refrigerators etc., on the other hand for a quick commerce dark store these items are needed but they don’t have to be fancy or appealing since customers won’t be looking at them.

2. Rent

There is a major price difference between the rental cost for a brick & mortar and a quick commerce store. A brick & mortar store has to be set up in a prime location with high footfalls that will catch the eyeballs of the audience. As compared to a quick commerce dark store which does not have to be in a prime location and is considerably more affordable.

3. Manpower cost

Brick & mortar businesses involve a large number of customer interactions. Resulting in a need for skilled labor that is proficient with customer engagement. The cost for skilled workers is much higher than that needed in a quick commerce dark store since there is little to no customer interaction.

4. Shrinkage

Shrinkage in the grocery business refers to a loss in inventory. The main focus of a quick commerce business is all about operational efficiency. As a result, there is a greater degree of control over the inventory which allows for reduced shrinkage. You can read about some tips to reduce grocery shrinkage here.

5. Utilities

Utility costs in a grocery retail store can go up to 15% of the stores overall operating budget according to bizenergy advisor. In an industry where profit margins are so low, it is imperative to take into account the utility cost while considering unit economics as this cost is often misunderstood and could be eating away at your budgets more than you realize.

6. Maintenance

A brick & mortar store has to be presentable since customers would be walking in and the store atmosphere plays a key role in the overall customer experience. On the other hand, a quick commerce dark store only has to focus on the maintenance of critical operational functionalities rather than the overall appearance of the venue and thus has a lower maintenance cost.

7. Delivery cost

Delivery costs are one of the key differentiating factors. If we total all per sqft costs in the table above both for brick & mortar and quick commerce, the operating cost per sqft is 25% lesser in the case of quick commerce.

“Delivery” is one of the key value differentiators for quick commerce but if not managed well, it can make the operations as expensive as for a brick & mortar store.

There are two ways in which deliveries can be conducted and each has its own unique benefits. To get an in-depth understanding you can learn more here.

In-house fleet

Having an in-house fleet means employing delivery riders on your payroll. By having an in-house delivery fleet, one can exercise complete control over the priority and delivery of orders. The critical thing is to have a delivery management system in place to get maximum efficiency from your fleet.

Third-party logistics

Third-party logistics (often known as 3PL) is a delivery model in which a business outsources its delivery operations to a company that holds expertise in that field.

In our view, we propose a hybrid delivery model with the flexibility to use both in-house and third-party delivery service providers. This combination of using both in-house deliveries along with 3PL logistics is called Delivery Orchestration.

Conclusion

To sum it up, having a brick & mortar business has its own set of opportunities with in-store marketing activities becoming a part of huge growth prospects, quick commerce tends to tap into the changing preferences of the consumer post-COVID. Nowadays customers are used to shopping with the tap of a button on the go.

Quick commerce could be a good alternative to get into as compared to going ahead with a brick & mortar grocery retail store. The one thing that is clear in the case of going for a quick commerce model. Businesses must have their own delivery fleet in order to be more profitable compared to a brick & mortar business model.

Simply having your own delivery fleet might also prove to be ineffective if their operational efficiency is not maximized. This is where Tookan can help. Tookan is an advanced SaaS-based delivery management solution that helps businesses to maximize the operational efficiency of their delivery operations.

Subscribe to stay ahead with the latest updates and entrepreneurial insights!

Subscribe to our newsletter

Get access to the latest industry & product insights.