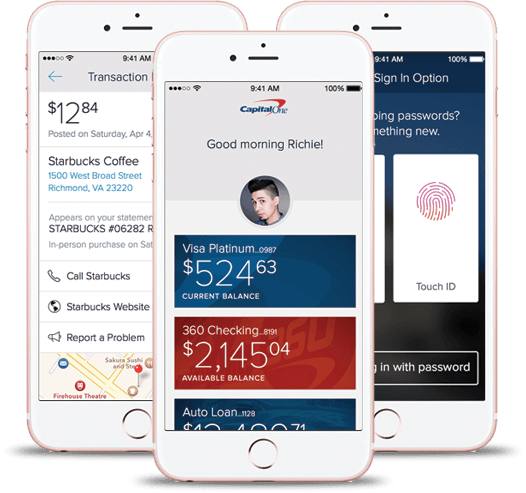

One of the biggest banks of USA uses Juggernaut to drive mobile ATMs to you

Capital One is an American bank holding company specializing in credit cards, home loans, auto loans, banking and savings products. When measured in terms of total assets and deposits, Capital One is the eighth largest bank holding company in the United States. A member of the Fortune 500, it helped pioneer the mass marketing of credit cards in the 1990s. With the rise of disruptive business solutions based on a robust technology core, Capital One focussed on making the existing solutions of ATMs more effective for customers.The idea behind on-demand ATMs was to leverage the ubiquitous smartphone usage and equip consumers with an app that would let them withdraw cash from wherever they are, without having to waste valuable time finding and walking to an ATM.

Challenges

While on-demand ATMs make things very convenient for the end user, the platform needed to be very secure to source trust from the customers. There were a number of challenges that we faced during the development of this app.

- Privacy and security in a financial transaction is of paramount importance. The platform had to be designed so that there was no loss or transfer of sensitive information. It was necessary that all communication between the provider and customer be encrypted.

- Customers needed to be efficiently matched to the nearest driver and the platform needed to aid real time and instant communication between the ATM truck driver and the customer. A solution also had to be found to the scenario when two requests were simultaneously made.

- We had to develop the solution where only a Capital One 360 customer will be able to use deposit facility of ATM, while any user can use withdrawal facility

Solution

We approached the problem with a clear focus in mind - that of making an intuitive platform that would make the process of requesting and receiving money a transparent and painless procedure. At the same time, the business side of the app was also made keeping in mind the need for efficient matching of ATM trucks to customers who are requesting it.

- Security : Only names of requesters can be seen by the drivers of ATMs. Information had to be very private, so we created an in-app communication channel that aids interaction between Capital One and its clients.

- Multiple Requests :Only instant booking is allowed on the platform which allows for better communication and feedback. A queue based system deals with multiple requests in the same zone. Each person who’s requested the service can see the number of customers waiting to be serviced before him and the time it will take for the ATM to reach him.

Outcome

- Capital One saw a drastic increase in ATM transactions, owing to the fact that more Capital 360 account holders were opting for on-demand ATMs and not choosing to withdraw from other banks’ ATMs

- Route optimization on the app allowed for quicker response times by drivers

- Live tracking and transparent queues reduced canceled requests by providing an accurate estimate of time taken for fulfillment of request

- Customers were able to pay at cash-only locations without wasting time and prevent excess charges for swiping cards