Everyone wants to hit it big online. E-commerce is no more an alternative to buying in-store. As Shopify predicts the growth of e-commerce to hit $4.5 trillion in 2021, finding funding for your Online Marketplace is serious business.

The evolution of e-commerce has opened up a lot of funding options. In this blog, we will go through the available options for marketplace funding and pick the right one that matches your business.

There are a few questions to be answered to choose the right source of funding for your business:

1. How fast do you need the money?

2. How much money is required?

3. How is the financial history of the business? Is it good enough to show it to a lender or investor?

4. What are you looking to finance?

5. Are you looking to pay out the interest or looking to give out equity?

Once you’re sure with these answers, let’s go through the options for financing.

1. Bootstrapping/Start Saving

If you are looking to try out your idea or test your business plan, then it is always best to invest your own money. Many startups look out for investment when they have not injected their own money into the business. The distinct advantage is that you will not have any debt associated with your company.

In case of Online Marketplace, use a SaaS platform to build your online marketplace, then start acquiring customers organically. Once your idea is testified, and you begin making few transactions in your platform then look out for investment.

2. Join an Accelerator, Incubator or Mentoring program

Ideal for first-time entrepreneurs

First-time entrepreneurs or founders can benefit enormously by joining an incubator or accelerator program. Tech-based incubators are present in almost all states in the country. There are even online incubators. The advantages include the availability of valuable resources, tools, expertise and connections that help the startups reach a stronger position to get funded.

3. Crowdfunding

Best for new tech-startup

For new tech-startup, crowdfunding is the best way to raise money. Crowdfunding provides startups with more financial freedom when compared to other sources of funding.

The popular crowdfunding platforms include Kickstarter, Indiegogo and GoFundMe. Some of these allow companies to raise funding in exchange for equity.

4. Business Line of Credit

Best for incremental business expenses

When you’re at an initial stage of building your marketplace business, one could not estimate the expenses required over a period accurately. You will notice that the funds are needed here and there and not all at once, the business line of credit is an excellent source of funding for the same.

The business line of credit is a hybrid of a bank loan and a credit card. The line of credit allows you to withdraw against a pre-approved amount of financing and the interest is paid only for that borrowed amount.

Advantages:

Only Pay Interests on funds withdrawn

Applicable to a wide range of businesses

Lower Credit score is accepted

Capital is available when needed

Disadvantages:

Document verification is required on each withdrawal

Collateral might be required

Higher rate of interest for lower credit scores

5. Inventory financing (Purchase Order Financing)

Best for companies in a period of unexpected growth

Online businesses can be a slow burn. But, sometimes there are chances that demand boosts for your products, and you do not have the resources to fund your supply. Let’s take an example; a celebrity gets photographed with your bespoke bedspread, all of a sudden your orders will spike, in this case, inventory financing can help. The lender will fund a large portion of your production cost to the seller or manufacturer. You’ll pay interest to your lender.

Advantages:

Easy to Qualify

No personal guarantee is required

Flexible funding

Good for startups

Disadvantages:

The fees are high

100% financing is not guaranteed

Short term funding

Not Available for Service Businesses

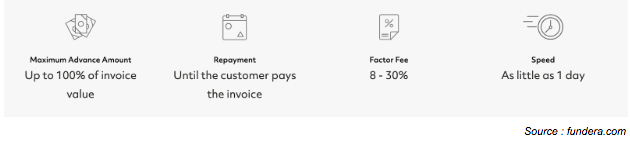

6. Invoice financing

Best for companies with irregular cash flow

Marketplaces can have both types of customers B2C and B2B. In the case of B2B customers, it is normal to extend the pay off time for the buyers. This can make your cash flow uneven which affects production. In this case, the lender will provide you with an upfront cost of up to 85% of the outstanding invoice. When you collect the invoice, you will receive the remaining balance minus the lender’s fee.

Advantages:

No need to wait for invoice payments

The Invoices serve as collateral

Based on the credit of the invoiced business

Disadvantages:

Fees higher than traditional financing

Fees based on time for invoices to be paid off

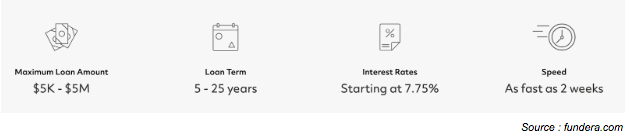

7. SBA loans

Best for an established business looking to expand

Small business administration guarantees these loans. This government agency provides loan guarantee up to 85% of the loan amount acquired from the SBA approved lenders- typically banks. Securing an SBA loan is not easy and is time-consuming. A good credit score is mandatory to qualify for an SBA loan.

Advantages:

Reasonable Interest rates

Long payment terms

Lowest down payment

Disadvantages:

Lengthy paperwork

Collateral may be required

Longer time for approval

8. Venture Capital

Best for startups with a disruptive idea and large capital requests

If you’re looking to hit it high and you require funding of the order of several hundred thousand dollars or even millions then venture capital is the best suited. Venture capitalists look out for those companies that have a significant differentiation from its competitors. They call it “Disruption”, changing the way businesses operate.

Getting venture capital funding is a long road that needs a lot of hard work. In the case of venture capital funding you do not pay any interest for the amount received but rather a stake in the company is offered to the investors.

Advantages:

No fees required

Large Capital requests

Disadvantages:

Owner’s equity is reduced

Lower financial freedom

Whether you already own an Online business or your looking to start a new one, it is rewarding to become your own boss. The best way to start is to validate your idea, grow your transactions and then look out for investment. If financing is the only thing that is stopping you, then there are many options out there for every business type to succeed.

If your looking to start your own Online Marketplace business, try Yelo

Subscribe to stay ahead with the latest updates and entrepreneurial insights!

Subscribe to our newsletter

Get access to the latest industry & product insights.