- Products

- Solutions

- Learn

- Partner

- Try Now

The most awaited IPO of the year has hit Dalal Street today and looks quite promising despite mixed reviews from the analysts. It is the first public listing offer by an internet company in India and sets the stage for many internet brands to follow.

- Fundamentals

- Timeline

- IPO essentials

- Competitive Strengths

- Growth Strategy

- Zomato’s financials

- Delivering Hot: news update

Fundamentals:

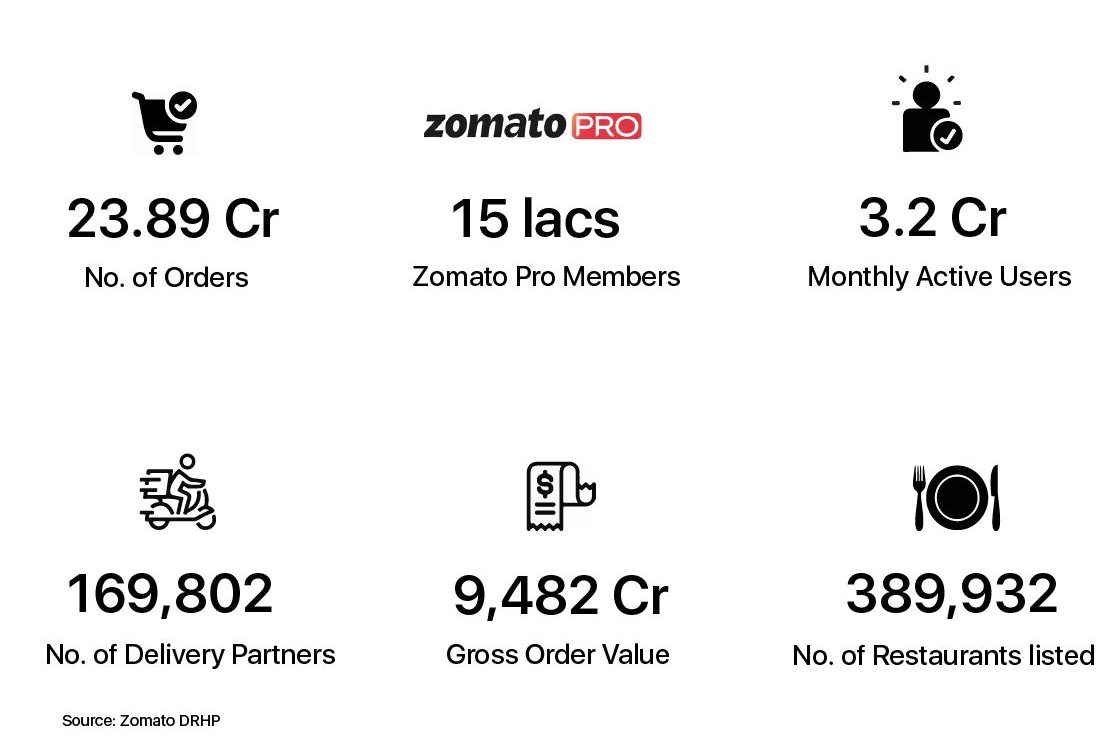

Presence: 525 cities among 23 countries (as of March 2021)

Partner Restaurants: 389932 (As of March 2021)

Promoters: Zomato is a professionally managed company and hence, there are no members forming part of the ‘promoter group’. As of July 6, the company has 74 shareholders. Pure-play internet company Info Edge (India) is the largest shareholder in Zomato with an 18.68 percent pre-offer equity stake, followed by Uber B V (9.19 percent stake), Alipay Singapore Holding (8.39 percent), Antfin Singapore Holding (8.26 percent), Internet Fund VI Pte Ltd (6.04 percent), SCI Growth Investments II (6.03 percent), and Deepinder Goyal (5.55 percent).

Timeline

Over the years, Zomato acquired a large number of companies which even included one of its biggest competitors, UberEats.

IPO essentials

- Rs 9,375-crore public offer comprises a fresh issuance of equity shares of Rs 9,000 crore, and an offer for sale of Rs 375 crore by existing selling shareholder Info Edge. Up to 65lakh equity shares are to be reserved for Zomato employees.

- The IPO is open now and bidding will close on 16th July. Window for subscription is open from 10:00 to 16:30 IST

- Price band for IPO is fixed at Rs. 72-76 per share and investors can bid for lots in multiples of 195 shares. Maximum of 13 lots can be applied.

- The objective of IPO is to utilise its net proceeds from fresh issue for funding organic and inorganic growth initiatives (Rs 6,750 crore); and general corporate purposes.

- The company will finalise the IPO share allotment around July 22, and the funds will be refunded or unblocked from ASBA account around July 23, 2021.

Equity shares issued will be credited to eligible investors’ Demat accounts around July 26, and shares will debut on the bourses on July 27.

Kotak Mahindra Capital Company, Morgan Stanley India Company, and Credit Suisse Securities (India) are the global co-ordinators and book running lead managers to the issue. BofA Securities India and Citigroup Global Markets India are the books running lead managers to the offer.

You can read more about Zomato IPO at Chittorgarh.com

Competitive Strengths

- It has strong network effects as a result of its distinctive content and transaction flywheels. According to RedSeer, its end-to-end food services approach makes it the most unique food services platform globally, combining the offerings of platforms such as Yelp, DoorDash, and OpenTable in a single mobile app.

- It has an extensive and effective on-demand hyperlocal delivery network.

- The company is a technology-first organisation that uses artificial intelligence, machine learning, and deep data science to drive continuous platform innovations for its community of customers, delivery partners, and restaurant partners.

- Zomato is a strong consumer brand that is well-known throughout the country.

Growth Strategy

- It seeks a continuous focus on unit economics and growth.

- It plans to grow and strengthen the community across its three businesses – food delivery, dining out, and Hyperpure.

- It will invest in new products, technologies, and features for its customers’ benefit.

- It will continue to invest in developing a strong consumer brand that is recognised throughout India.

Learn more about Zomato Business Model.

Zomato’s financials

The food delivery company’s consolidated loss at Rs 2,385.6 crore in the financial year ended March 2020 widened from a loss of Rs 1,010.2 crore in the previous year. But revenue nearly doubled to Rs 2,604.7 crore from Rs 1,312.58 crore in the same period. Consolidated loss for financial year FY21 stood at Rs 816.43 crore on revenue of Rs 1,993.78 crore. The decline in revenue was largely due to the impact of Covid-19.

Delivering Hot: news update

Zomato has already mobilized 552 million shares worth Rs 4,196.51 crore from 186 anchor investors on July 13, a day before the issue opening. It was subscribed 35 times by them ahead of launch and the size has been reduced to Rs 5,178.49 crore from Rs 9,375 crore earlier.

BlackRock, Tiger Global Investments Fund, Fidelity, New World Fund Inc, JP Morgan, Morgan Stanley Asia (Singapore) Pte-ODI, Goldman Sachs (Singapore) Pte -ODI, T Rowe, Canada Pension Plan Investment Board, Government of Singapore, Monetary Authority of Singapore and Abu Dhabi Investment Authority are among the anchor investors.

The domestic investors who participated in the anchor bidding include Kotak Mutual Fund (MF), Aditya Birla Sun Life MF, Axis MF, SBI MF, UTI MF, HDFC MF, ICICI Prudential MF, IDFC MF, Sundaram MF, Edelweiss MF, ICICI Prudential Life Insurance Company and HDFC Life Insurance Company.

According to Mint, The retail portion of Zomato IPO was subscribed nearly 100% within a few minutes of opening. Within 4 hrs, the public offering was subscribed twice and demand is still growing. To read more and the latest on the success of Zomato’s IPO click here.

Jungleworks is looking forward to Zomato’s IPO and public listing. Apart from being a shareholder, Zomato also sets a benchmark for Jungleworks being the first internet company in India to get publicly listed. Yelo empowers entrepreneurs to build a platform like Zomato. If you are interested in creating your own hyperlocal marketplace, you can visit Yelo. Or you can download ebook below to learn more about creating food delivery apps.

Subscribe to stay ahead with the latest updates and entrepreneurial insights!

Subscribe to our newsletter

Get access to the latest industry & product insights.